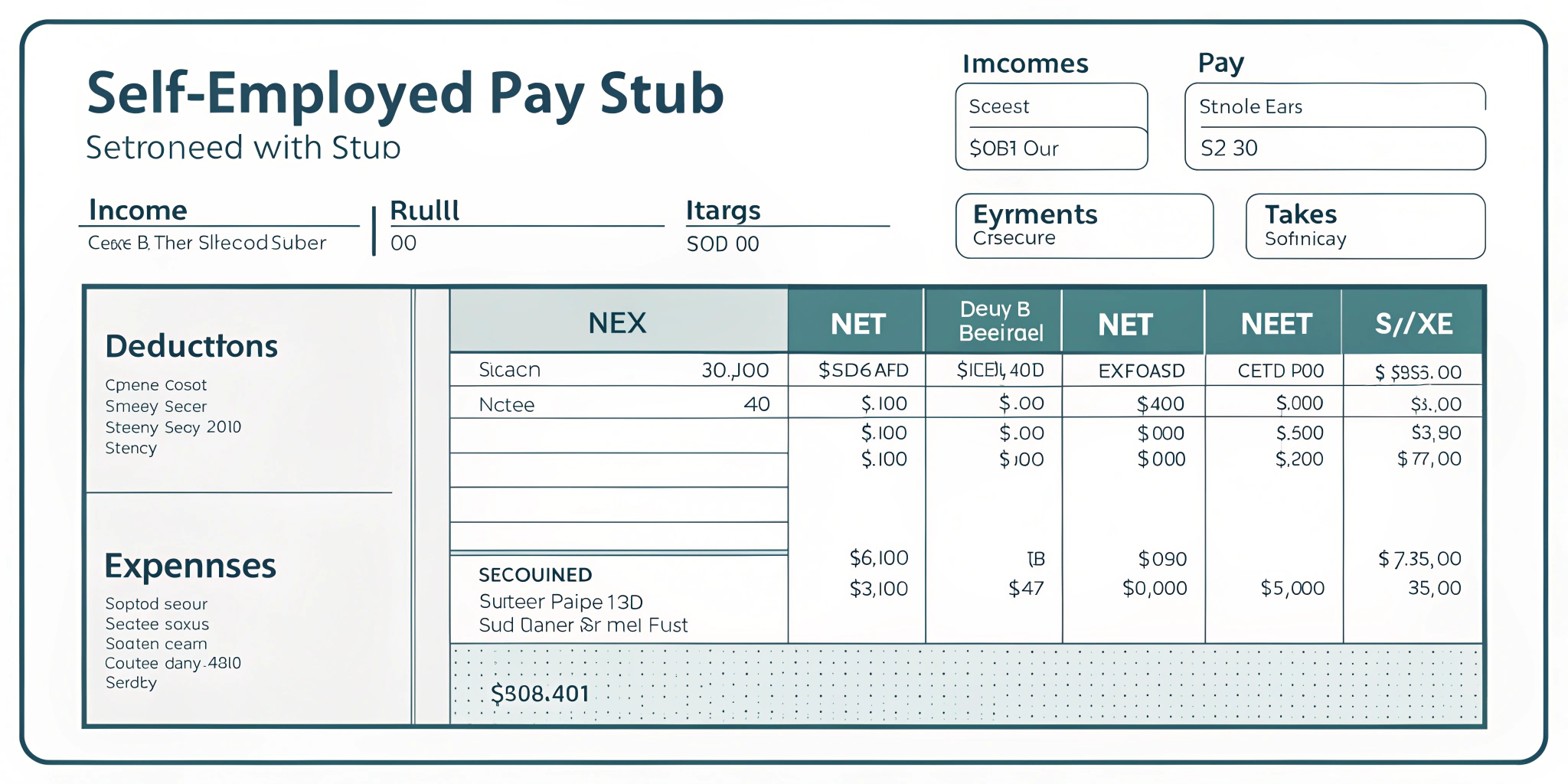

What Should Be Included in a Self-Employed Pay Stub?

Whether you're a freelancer, contractor, consultant, or small business owner, being self-employed doesn’t exempt you from needing solid documentation of your income. A self-employed pay stub is one of the most professional ways to show proof of earnings for loan applications, rental agreements, taxes, and even client billing transparency.

But what exactly should go into a self-employed pay stub? Let's break it down in detail.

1. Personal Information

Every pay stub whether for an employee or a self-employed individual should begin with clear and accurate personal details. This includes:

● Full Name

● Business Name (if applicable)

● Address (residential or business)

● Phone Number or Email

● Tax ID or EIN (if registered as a business)

These details establish identity and legitimacy, especially when used for official purposes like bank loans or government filings.

2. Employer Information (You, as the Business Owner)

Even though you're self-employed, you're essentially both the employer and the employee. Include:

● Your registered business name

● Business address

● Contact information

● Logo (optional but professional)

This lends credibility and mimics the structure of a traditional pay stub.

3. Pay Period and Pay Date

Clearly indicate:

● The start and end date of the pay period (e.g., 01 June – 15 June)

● The payment date (the day the pay stub is issued)

Regular pay periods (weekly, bi-weekly, or monthly) help maintain a consistent financial record, which is helpful for budgeting and tax purposes.

4. Gross Income

This is the total amount earned before any deductions during the pay period. It should include:

● Project payments

● Retainers

● Hourly or contract rates

● Commission, if applicable

If your income varies, it's best to calculate and display gross earnings by project, client, or hours worked.

5. Deductions

As a self-employed professional, you're responsible for your own taxes and other business-related deductions. Your pay stub should reflect:

● Federal & State Estimated Taxes

● Self-employment Tax

● Health Insurance Premiums (if applicable)

● Retirement Contributions (like SEP IRA or Solo 401k)

● Business Expenses (optional, if broken down)

6. Net Pay

This is your take-home income after all deductions have been made. It reflects the actual amount you’ve earned for personal use.

Net pay = Gross income - Total deductions

It’s especially useful when showing lenders or landlords what your actual income looks like on a recurring basis.

7. Year-to-Date (YTD) Summary

A self-employed pay stub should also show:

● YTD Gross Income

● YTD Deductions

● YTD Net Pay

This gives a broader picture of your earnings over the fiscal year and helps with tax planning, financial reporting, and meeting requirements for income verification.

8. Optional Fields (For Added Professionalism)

While not mandatory, these details can further legitimize your pay stub:

● Payment Method (e.g., Direct Deposit, PayPal, Check)

● Invoice or Job Reference Number

● Client Name or Project Title

● Pay Stub Number (for record-keeping)

Why Use a Pay Stub Generator as a Self-Employed Individual?

Creating these pay stub manually is possible but time-consuming. A tool like PayStubGenerators.com simplifies the process by allowing you to:

● Quickly enter your details

● Choose a professional template

● Download and print on the spot

● Maintain records for taxes, lenders, or client communication

Conclusion

A self-employed pay stub isn't just a piece of paper it's proof of your professionalism, income reliability, and financial organization. Including all the right details not only makes your records look more legitimate but also helps you in moments that count whether it's buying a home, filing taxes, or impressing a new client.